Welcome to Power Line, a weekly energy newsletter brought to you by Business Insider.

Here’s what you need to know:

- Want to get Power Line in your inbox every Friday? Sign up here.

- Most of our content is available to BI subscribers. Click here for 20% off.

- Got feedback or tips? Email us at [email protected].

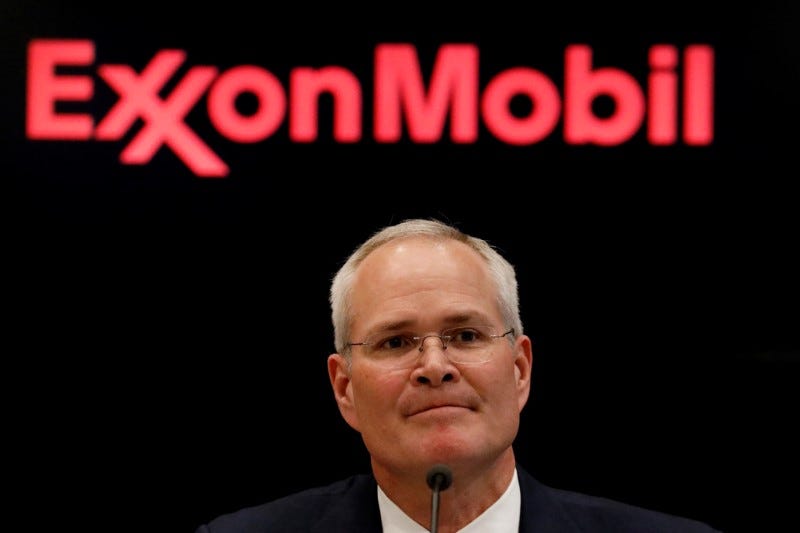

Inside Exxon’s employee ranking system

Exxon says it has no plans for layoffs. Former employees and documents leaked to Business Insider tell a more complicated story.

This morning, we reported that Exxon – which had 75,000 employees at the end of last year – made a change to its internal performance review system that exposes a large portion of its US workforce to job cuts.

- The company expanded the minimum number of employees that must be classified as "Needs Significant Improvement," or NSI, in the annual review cycle.

- Some of those employees are forced to resign. Others have the option to enroll in a performance improvement plan.

- Current and former employees said that Exxon is obscuring layoffs in performance-based cuts.

You can read the full story here.

Are you a current or former Exxon employee? You can reach me at [email protected] or through the secure messaging up, Signal, at 646-768-1657.

What Exxon said: "We do not have a target to reduce headcount through our talent management process. Employees who need significant improvement (NSI) are given a plan and opportunities to improve their performance."

Big Oil is starting to report earnings. Expect big losses.

Exxon is among seven top oil companies commonly referred to as "majors" that are reporting earnings in the coming days. It's expected to be brutal.

What analysts are saying: "The vast, vast majority of companies are still in survival mode," Valentina Kretzschmar, an analyst at Wood Mackenzie, said. "Second-quarter results are going to be very, very ugly."

- Analysts expect all companies that have yet to report - including Exxon, Chevron, BP, Shell, Eni, and Total - to report large losses.

- Equinor reported results on Friday, beating analysts' expectations.

- Read our full story, covering the outlook for dividends, clean-energy investments, and growth in petrochemicals.

Related news: Schlumberger, the world's largest oil field services company, said it would cut 21,000 workers. OFS companies are among the hardest hit when oil prices crash.

Reminder: We're keeping track of how 20 top companies are responding to the downturn. Let us know what we've missed, or send us a tip.

Tesla lost its major lead in solar - and analysts say it's unlikely to win it back anytime soon

Yes, Tesla does, in fact, sell more than just beloved electric cars. In fact, SolarCity, the solar installer it acquired in 2016, was once the largest residential installer - by far.

- In 2015, SolarCity controlled more than a third of the market for residential solar, according to the research firm Wood Mackenzie.

- The second-largest company at the time had just 11% of the market.

Fast forward: In the years since, Tesla has slipped far behind its competitors like Sunrun and Vivint.

- The company had about 5% market share at the end of last year.

- It doesn't help that Sunrun recently announced plans to buy Vivint, heating up the competition. You can read our chat with Sunrun's CFO here.

- Tesla has the cheapest solar offering in the US, according to CEO Elon Musk, which analysts at Wood Mackenzie confirmed.

- Still, installations reached an all-time low this quarter. The company cited the coronavirus pandemic, which caused permit offices to close.

- And what about the solar roof? We still, somehow, don't know much about it. Wood Mackenzie says the company only installed about 100 roofs in California, the largest solar market, in the first quarter of 2020.

What's next: Read our full story on what experts are saying about the future of Tesla's solar business.

- And check out this story by Ben Winck about why billionaire Chamath Palihapitiya thinks Tesla's EV business will give way to a bigger focus on renewable energy down the … road.

Our 5 top stories of the week:

- The cofounder of ClassPass just joined a buzzy startup that sells clean energy. He gave us an inside look at the products he's designing, and shared how they could reshape a $1 trillion industry.

- Microsoft just invested $50 million in a buzzy fund that makes bets on the future of energy. A partner of the fund laid out the 'fundamental paradigm shift' that's shaping his strategy.

- Chevron said some workers would lose their jobs in its massive merger with Noble Energy. Here are the roles being targeted for cuts.

- The pandemic accelerated energy giant Phillips 66's push to modernize its IT and revamp the $109 billion business. The company's chief digital officer gave Joe Williams the inside scoop.

- Solar power could become cheaper and more efficient thanks to a new method that creates electricity from invisible light. Aaron Holmes has the story.

That's it! Have a great weekend.

- Benji

Ps. Only one plant in my low-effort garden is thriving - and it's the one I didn't plant. This pumpkin-and-or-watermelon sprung up from the compost I used to nourish the plants I paid for, and quickly strangled them.